Turning a Negative into a Positive through Tax Loss Harvesting

Nobody likes losing money. Am I right? It’s never a fun experience.

But we know, as experienced investors, that market volatility is a part of the game. In fact, research tells us that Bear Markets occur roughly every 56 months, according to S&P Dow Jones Indices.

So when you find yourself in a position where you’ve incurred some investment losses, it helps to have a proactive strategy that will help you pay fewer taxes along the way and keep more of your hard-earned money.

One of those strategies is called tax-loss harvesting.

Tax loss harvesting uses investment losses to help offset investment gains and in turn, lower your overall taxes.

Think of these losses as a strategic move and more like a silver lining that can work for you to either reduce your income today or allow you to store up your losses for later on down the road to help reduce your tax bill in retirement.

In this article, we’ll talk through the basics of tax loss harvesting, what it is, how it works, why it can be beneficial, and some important rules to remember.

Starting with the basics

Let’s imagine for a moment, that you are reviewing your investments inside of your account and you notice that one of your investments in a technology company has done really well. Upon looking at the rest of your investments, you spot that another one of your investments within a healthcare company has not performed so well and has dropped in value.

What should you do?

Well first, we should note, that it is generally a good idea to periodically rebalance your portfolio, and bring it back into alignment. This helps to diversify your portfolio and more importantly, it avoids your portfolio from becoming too top-heavy and overly dependent on the returns from one or two companies; which can be extremely risky.

When you decide to rebalance your portfolio, the decision to sell a portion of both your winners and your losers will allow you to reduce your overall tax liability through tax loss harvesting.

How does this work?

Sell an investment that has underperformed and is now worth less than what you bought it for.

Note: Doing this now creates a “Realized Capital Loss”

Reinvest the money you have from the sale into a different investment that fits within your overall investment strategy and target asset allocation.

Note: Your reinvestment cannot be back into the same investment you sold out of. This violates the Wash Sale Rule, which we’ll speak more about later.You decide! There are several options you can choose as to what to do with your realized capital loss. We’ll explore the various options below in detail so that you can determine which one is most appropriate for you.

Helpful Pointer: If you’ve experienced significant portfolio losses due to market volatility, you could carry forward any unused capital losses and save them for the following year to use to offset future capital gains when you begin drawing your retirement income from your taxable brokerage account.

Benefits of Tax Loss Harvesting

We know that every investment isn’t always going to be a winner and as discussed earlier, market volatility will occur at some point during your investment lifetime. When these things happen, it is important to remember that having the right approach and an understanding of taxes can help you lower your tax liability.

When you have decided that it is time to sell an investment at a loss, whether that’s to get rid of the declining investment altogether or to do a portfolio rebalance, you will lock that investment in at a loss. With that realized loss, you can decide whether you’d like to utilize your tax loss either today or in the future. Here are some of your options below.

What can you do with your investment losses?

Use all or a portion of your losses today to offset any current investment gains within your portfolio

Use up to $3,000 of realized portfolio losses to reduce your ordinary income on federal income taxes

“Carry forward” any used losses into future tax years and lower your future tax liability

In our example above, the client decided to sell the technology stock at a gain and simultaneously sell the healthcare stock at a loss, which allowed them to use the losses from the sale to offset their investment gains, and in turn, lower their overall tax liability.

We’ll walk through a real-life example, step-by-step in just a moment, and be sure to include visuals so that this concept becomes crystal clear.

Important Tax Terms to Know

Before we dive into a real example of tax loss harvesting in action, it’s important to know several key terms and tax rates.

Long–term capital gain is the gain on the sale of an investment that you owned for more than a year before selling. Similarly, a long–term capital loss occurs when you sell an asset at a loss that you owned for more than one year. Taxes on Long-Term capital gains range from 0 to 20%, depending on your income.

Click here for a great chart explaining the capital gains tax rates based on your Income.Short–term capital gain is the gain on the sale of an investment that you owned for less than one year before selling. As like it sounds, a short-term capital loss occurs when you sell an asset at a loss that you owned for less than one year.

Note, short-term capital gain rates are taxed at your ordinary-income rates, which tend to be higher and are therefore less favorable than long-term capital gain rates. This caveat acts as an incentive to buy and hold investments for longer than one year.

A Real World Example

Let’s look at an example and say that you have a gain of $20,000 on an investment you bought less than a year ago and decided to sell. Creatively, we’ll call it Investment A.

At the same time, you also decide to sell shares of another stock for a short-term capital loss of $25,000. We’ll call this Investment B.

Here are the two transactions that you made:

Sale 1: $20,000 gain from Investment A

Sale 2: $25,000 loss on Investment B

Net Result: $5,000 Capital Loss

In this scenario, you would owe no taxes on the gain from Investment A and because you had a leftover loss, you would get to decide how you could use the remaining $5,000 in losses to either carry forward for future years or offset $3,000 of your ordinary income.

Because you held the stock for less than a year, this gain is treated as a short-term capital gain and unfortunately will be taxed at the higher ordinary-income rates.

Assuming you decided to apply the $3,000 of losses to reduce some of your Income, this would leave you with $2,000 for future years to carry forward.

Understanding the Math Behind the Tax Savings

The decision to offset all of the capital gains of Investment A with capital losses of Investment B potentially saved $7,000 on taxes - To calculate this, you simply take your would-be gain and multiply it by your Ordinary Income tax rate: $20,000 × 35% = $7,000

In this example, because our losses were greater than our gains ($25,000 - $20,000), our $5,000 loss will allow us to reduce our ordinary income by $3,000, which can potentially lower our tax liability by an additional $1,050.

To calculate this, you would multiply your loss by your tax rate.

$3,000 × 35% = $1,050When you add the two tax moves together ($7,000 offset + $1,050 income reduction), you have $8,050 of potential tax savings that tax-loss harvesting has accomplished for you.

Furthermore, because you are limited to $3,000/year to use to reduce your Ordinary Income, you could then apply the remaining $2,000 of your capital loss from Investment B ($5,000 – $3,000) to gains or income the following tax year.

Important Rules to Remember

Like with anything, terms and conditions apply. Below are rules and limitations to remember when attempting to tax loss harvest:

Tax loss harvesting cannot be used within retirement accounts like Traditional IRA, Roth, or 401k because you cannot deduct losses inside of a tax-deferred account. It only works within your taxable account.

You cannot intentionally sell a security at a loss and then buy it back within 30 days. Doing this is in violation of the Wash Sale Rule and your losses will not count. You cannot buy the same or a "substantially identical" security within 30 days before or after the sale. The loss is typically disallowed for current income tax purposes.

Like for Like: As we discussed earlier with the different types of capital gains, long-term losses must first be paired with long-term gains. Similarly, short-term losses must also be applied to short-term gains. If there are leftover losses in one category, these can then be applied to gains of either type.

Avoid selling an investment just to get the loss - Remember why you invested in a particular fund or company in the first place and how it fits into your overall strategy. Stocks can be volatile, so if you’re holding a particular stock for its long-term potential, selling it just to realize a quick tax break may not be the best strategy.

Closing Thoughts:

As experienced investors, we know, that market volatility is a part of the game. Like it or not.

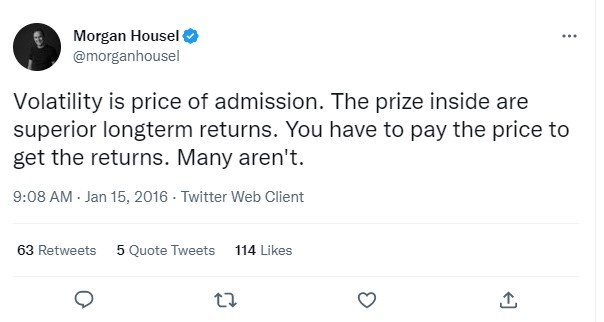

In fact, it was renowned author, Morgan Housel in his book, “The Psychology of Money”, who famously wrote:

We also know, that in order for us to experience the fruits of long-term investing, volatility will be a part of the process.

And it is our reactions and decisions during volatile times that will impact our investment results the most.

Using a strategy like tax loss harvesting can help to soften the blow and set us up for long-term investment success and a more favorable tax situation. This can be an advanced strategy and mistakes can occur when attempting to rebalance your portfolio. If you have any questions, it is best to consult an investment professional before proceeding.

Here’s to happy planning and to long-term investment success.

Onward.

Disclaimer: The views and opinions expressed are made as of the date of publication and are subject to change over time. The content of this website is for informational or educational purposes only. Website content is not intended as individualized investment advice, or as tax, accounting, or legal advice. It is not intended to be a recommendation or endorsement to buy or sell the specific investment. This information should not be relied upon as the sole factor in an investment-making decision. Website users are encouraged to consult with professional financial, accounting, tax, or legal advisers to address their specific needs and circumstances.