US Exceptionalism and Market Overconcentration

AMERICAN COMPANIES ARE UNMATCHED

The following chart may not have a big investing takeaway other than to help us appreciate the sheer size of the American stock market. As it stands, 20 of the world’s 25 most valuable companies (and 58 of the top 100) are in the U.S. For all the talk about the decline of America as a whole, American businesses continue to thrive while the rest of the world plays catch-up. (Source: Sherwood)

International developed equities and the U.S. dollar:

This chart below compares U.S. and international developed equity returns, showing that international outperformance often aligns with dollar weakness.

Favorable exchange rates and increased investment flows support international returns when the dollar falls. The recent strong dollar cycle favored U.S. equities, but current dollar weakness and cheaper international valuations suggest a possible shift ahead.

But widen the lens and it becomes clear that US and non-US stocks have traded periods of outperformance over the last 50 years at irregular intervals (Display).

The most recent run of US dominance ended in 2021. Between October 2022 and May 2023—a particularly strong stretch for non-US stocks—the MSCI EAFE Index of developed-market stocks outside the US and Canada delivered a net return of 26.2%, outpacing both that of the MSCI USA (13%) and the S&P 500 (13.3%).

Pay Attention to Market Concentration

Market concentration risk in the US is high. The technology-heavy top 10 components in the S&P 500 have accounted for more than 90% of index returns in 2023 so far. Non-US indices offer diversification through access to companies underrepresented in the US, such as European luxury goods makers, and important trends, including industrial automation in Asia.

US stocks still offer solid long-term return potential, in our view. But we think investors may have much to gain from venturing beyond the border to build a more globally diversified equity allocation.

Not All Bubbles Are Created Equally

It can be hard to see the silver lining of massive overinvestments made during mania-like times, but renowned tech investor Fred Wilson once shared:

"Nothing important has ever been built without irrational exuberance."

If that's true, then we may look back decades from now, thankful for the massive investments being made in AI right now, with a similar appreciation that we have today for the internet pioneers of the past.

What makes this look different that the Dot-Com Bubble: Corporate Earnings

The companies leading the charge in AI, so far, actually have the fundamentals to back it up. JP Morgan's Michael Cembalest shared the following in a new research piece this week:

AI-related stocks have accounted for 75% of S&P 500 returns, 80% of earnings growth, and 90% of capital spending growth since ChatGPT launched in November 2022.

These companies are spending like drunken sailors, but they can all afford the booze. And if you're invested in the market, you already have plenty of exposure to these gigantic tech stocks—which means their performance matters to your portfolio whether you realize it or not.

Just because this feels like some of history’s biggest bubbles doesn’t make it any easier to handicap.

So what do we do with all this?

I understand why many investors are worried about the prospects of a bubble. When they burst, it tends to be painful.

But here's the reality: the truth is no one is going to predict when the current cycle comes to an end. And if someone does, it will be pure luck that they'll be chasing for the rest of their career.

Just because this feels like some of history's biggest bubbles doesn't make it any easier to handicap. Calling the top is next to impossible because emotions matter more than numbers in the short-run. People are driven by narratives in an innovation boom, not data.

Every cycle comes to an end eventually, but you're far better off preparing for a wide range of results rather than predicting when the market will turn. Investing would be a whole lot easier if you knew when the tops and bottoms would occur in advance.

In lieu of a crystal ball, I diversify and invest for the long-run.

“Is Market Concentration a Long-Term Risk?”

There’s a lot of noise about the fact that today’s biggest companies make up “too much” of the S&P 500 index. As of July 31, the market cap of the ten largest companies made up about 39% of the index's total market cap[1]. That’s a big number, no doubt.

Of course, this is being peddled as a significant risk, just as it has been for quite some time now. To this point, at least, it hasn’t been the risk that’s been advertised, except for those who chose to underweight these dominant companies due to fear of their comparative decline[2].

In any case, high levels of market concentration are nothing new. In the 1960s and 70s, the Nifty-Fifty dominated portfolios, with the top 10 stocks making up about 30% of the index[3]. In 2000, tech and telecom companies pushed the top 10 to exceed 20% of the index[3]. Both concentrations were obviously lower than they are today, but they were both top-heavy periods, historically speaking.

It's important to note that none of the companies from the 60s or 70s remain in the top 10 today. And just two from 2000 make today’s list—Microsoft and Walmart[3+4].

This being the case, with all the rotation at the top, you might expect that long-term returns following those instances would have suffered and been considerably lower than historical averages. Not so much.

From 1965 to today, the market’s real (above inflation) return has averaged about 6% per year. Since 2000? About 5% per year. Compare those to the long-term average over the last century of about 7%, and you’ll see that our experiences since those times are roughly in line with history[5]. Most critically, all returns were well above inflation!

To be fair, there were rough periods of volatility that followed these peak concentration events, but the long-term returns show that market concentration posed little risk for long-term investors like us[6].

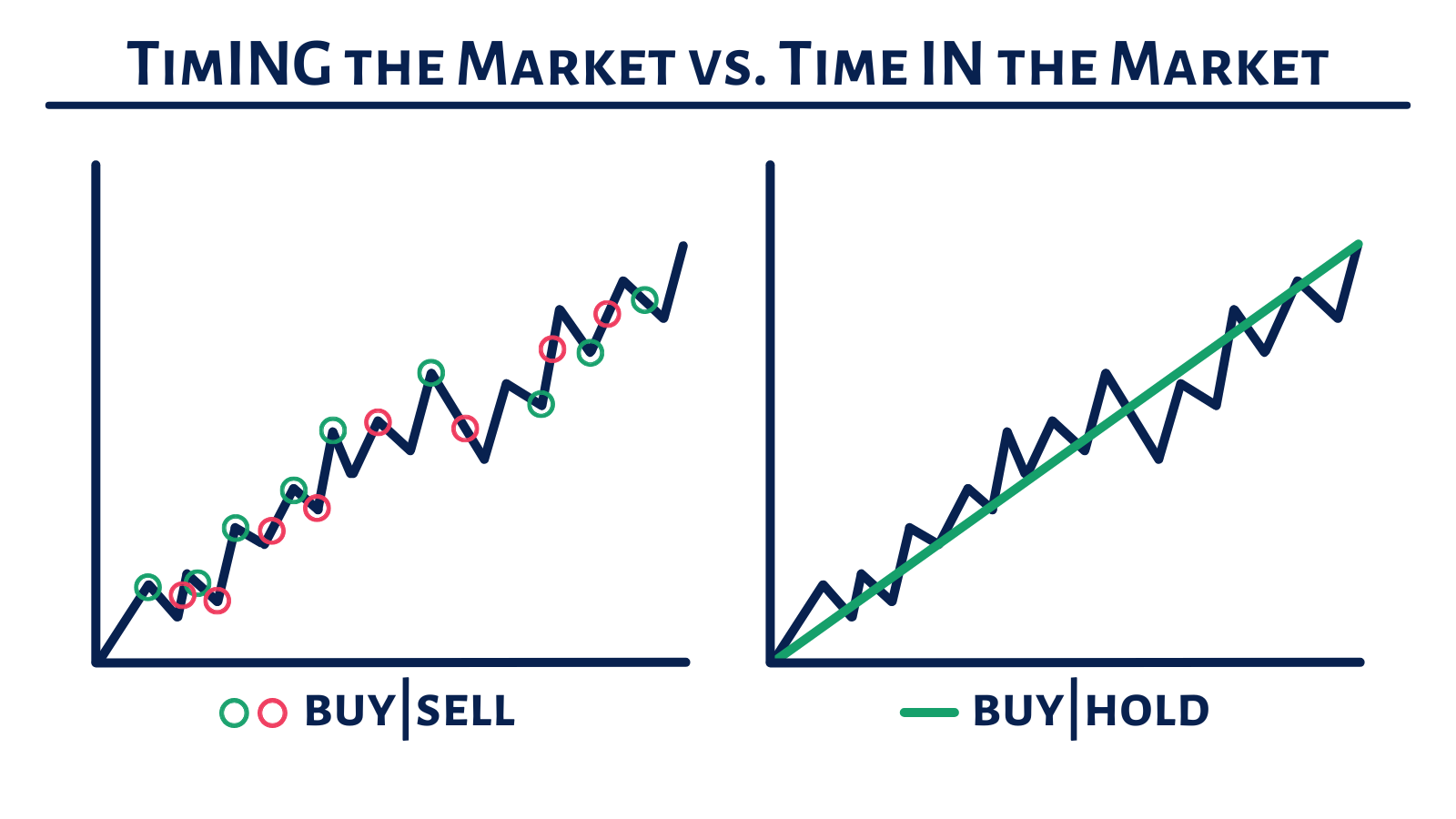

As alluring as it may seem to try avoiding any volatility that may be ahead, the only way I know to ensure we capture all the upside is, not surprisingly, to endure all the volatility along the way. It’s why we always say that time IN the market—not timING the market—is what matters most when investing toward your long-term goals.

Beyond this historical perspective, I think it’s fair to say that market concentration isn’t (generally) a sign that something is broken, but rather a reflection of what’s working.

As consumer preferences change, industries inevitably rise and fall, and the market naturally reallocates capital toward the most productive and profitable companies of the moment. This makes sense, but let’s look at how this has played out recently.

Today’s top 10 companies, which make up the aforementioned 39% of the index, account for 32% of the index’s total earnings[1]. This means that almost a full-third of all earnings is generated by just 2% of the companies. The sheer size, scale, and profitability of these companies is staggering.

With that fact in mind, are we to believe that this market concentration is a result of a market that is broken, or one that is functioning properly? Should we expect these companies to deteriorate overnight with that kind of dominance? It seems unlikely, but anything is possible.

Whether that happens or not, we can expect that today’s giants will eventually stumble. They’re certainly not invincible, but the point I want to make today is that the growing concern that this concentration is some kind of unprecedented danger ignores history—and economics.

I believe the big risk at all times, but especially during periods like this, is thinking that you (or anyone else, for that matter) can forecast this rotation and profit from the timing.

Of course, I believe the prudent approach is to continue being a permanent owner of our market-like diversified portfolios, which inevitably includes these profitable giants. This defaults into letting our winners ride, the laggards fall, and allowing time to do the heavy lifting. Just as it always has.

[1] J.P. Morgan Guide to the Markets – Slide 8

[2] Vanguard

[3] For Top Companies by Market Cap: Research Affiliates – See Chart on Page 3; For Concentration Levels: Morgan Stanley – See Chart on Page 3.

[4] Companies by Market Cap: As of 8.6.2025, Microsoft is #2 and Walmart is #10.

[5] Political Calculations [1965.01-2025.07; 2000.01-2025.07; 1926.01-2025.07]

[6] We plan for extended periods of volatility by owning other low-volatility assets to help provide for near-term lump sum and income needs. For those in the accumulation phase of life, the periods of volatility that followed these concentration events were opportunities to buy shares at comparatively discounted prices.

S&P: 6,386

Disclaimer: The views and opinions expressed are made as of the date of publication and are subject to change over time. The content of this website is for informational or educational purposes only. Website content is not intended as individualized investment advice, or as tax, accounting, or legal advice. It is not intended to be a recommendation or endorsement to buy or sell the specific investment. This information should not be relied upon as the sole factor in an investment-making decision. Website users are encouraged to consult with professional financial, accounting, tax, or legal advisers to address their specific needs and circumstances.Three Tax Efficient Ways To Give This Year and Beyond

Giving to a cause or charity, much like planning for retirement, is deeply personal. But while retirement planning usually happens out in the open, generosity often happens quietly, sometimes in complete privacy.

As a financial planner, nothing makes me happier than seeing clients light up when they talk about supporting causes close to their hearts.

That’s what creating alignment between your money and your values is all about.

Still, I know giving is often a private decision. Because of that, I often only learn about a client’s gift after it’s been made. And when I ask how they gave, the most common answer is: “I wrote a check” or “I gave in cash.”

On one hand, giving is giving—and that’s what truly matters in making a difference. On the other, the planner in me can’t help but think: Writing a check is rarely the most tax-efficient way to give.

And with the recent passing of the One Big Beautiful Tax Bill (OBBB), 2025 and beyond are shaping up to be one of the best stretch of years in recent memory to give strategically. So, I thought it would be worth sharing some of the most common—but still underutilized—giving strategies I see in my work.

More Bang for Your Buck

Under the new One Big Beautiful Tax Bill (OBBB), there’s a brand-new perk for givers, and this still applies— even if you don’t itemize your deductions.

That’s right: even if you take the standard deduction, beginning in 2026, you can still deduct up to $1,000 in cash donations if you’re Single or Head of Household, or $2,000 if you’re Married Filing Jointly.

Here’s the fine print (which in this case is actually good news):

Charitable Deduction for Non-Itemizing Tax Payers

Credited as an “Above-the-line” deduction — available even if you take the standard deduction

Charitable contributions not subject to the 0.5% AGI floor

Must be Cash contributions only

Can go to public or private charities (but not 509(a)(3) supporting organizations

Cannot be used to establish or maintain a Donor Advised Fund (DAG)

Here’s the fine print (which in this case is actually good news):

Charitable Deduction for Itemizing Tax Payers

Starting in 2026, those who itemize their deductions will — for the first time — be allowed to deduct their cash contributions only to the extent they exceed 0.5% of their adjusted gross income.

For example, say your adjusted gross income is $100,000. You will be allowed to deduct the amount of your total cash gifts minus $500 (0.5% of $100,000. So if you make $2,000 in cash contributions, you only will be allowed to deduct $1,500. Source: CNN Business

Three Ways to Give More Effectively in 2025

1. Give Appreciated Investments Instead of Cash

If you own investments in a taxable account that have been held for more than a year with significant unrealized gains, you can donate them directly to charity and deduct their fair market value.

The charity can then sell the assets without paying the capital gains tax.

This strategy allows you to avoid capital gains taxes (plus the Medicare surtax, if applicable) and still receive a full deduction for the donation, while the charity enjoys the full benefit of your gift. A true win/win.

BONUS: If your favorite nonprofit doesn’t accept securities directly, you could use a donor-advised fund (DAF) as a middle step. In this case, you could transfer the appreciated shares into the DAF, get the tax deduction in that year, and then provide “grants” to your chosen charities immediately or over time. Any funds not immediately distributed can grow tax-free.

2. “Bunch” Your Giving for a Bigger Tax Impact

With the expanded standard deduction, many people no longer itemize deductions each year, meaning some charitable gifts don’t create any tax benefit at all.

Therefore, if you can, you might want to consider “bunching” multiple years’ worth of giving into a single year.

In a bunching year, you give more than usual—again, using a DAF or similar setup—so that your itemized deductions exceed the standard deduction with the intent to spread the actual grants to charities over several years.

So instead of giving in December of 2025 and early 2026, you can bunch your donations together into one calendar year for a greater tax impact.

Bunching can also be especially valuable in high-income years, such as after a business sale, a large bonus, or other high-income events, when a tax deduction is worth more.

In either case, you could think of a DAF as a charitable “holding tank” for future giving.

3. Give Directly from Your IRA

If you’re over 70½, you can give directly from your IRA to a qualified charity using what’s called a Qualified Charitable Distribution (QCD). This is one of the few ways to distribute money from an IRA without it counting as taxable income.

For investors 73 or older who are taking Required Minimum Distributions, QCDs can satisfy some (or potentially, all) of that requirement. By keeping this income off your tax return, it could help reduce your Social Security taxability or decrease your Medicare premiums.

In other words, using your charitable endeavors to manage your taxable income can be valuable in ways that aren’t immediately obvious.

The Bottom Line

As surprising as it may sound, none of these strategies require complex planning. The biggest step is simply having the conversation before you write the check, so we can align the right strategy with your charitable goals—and make sure there’s enough time left in the year to put it in motion.

That’s why we bring this up in the summer, not in a last-minute scramble in late December. Once the process is set up, it’s usually easy to repeat year after year.

Here are just a few ways these strategies can be used:

Support a cause you care about at a higher dollar amount than you thought possible.

Reduce or eliminate a concentrated stock position without triggering a big tax bill.

Reduce your IRA balance in retirement in a way that benefits charity instead of the IRS, while potentially saving on taxes and Medicare premiums at the same time.

As I said earlier, I’m sharing these ideas to encourage conversation around giving strategically. I know that generosity isn’t necessarily about saving money on taxes, but my goal is to help you make the biggest impact possible, both for the causes you care about and your bottom line.

So, if one or more of these ideas sound appealing, let’s talk.

As always, stay the course.

Disclaimer: The views and opinions expressed are made as of the date of publication and are subject to change over time. The content of this website is for informational or educational purposes only. Website content is not intended as individualized investment advice, or as tax, accounting, or legal advice. It is not intended to be a recommendation or endorsement to buy or sell the specific investment. This information should not be relied upon as the sole factor in an investment-making decision. Website users are encouraged to consult with professional financial, accounting, tax, or legal advisers to address their specific needs and circumstances.Why More Money Doesn't Always Mean More Freedom

We’ve talked a lot about the relationship between time, health, and money — and for most people, accumulating money takes time.

But here’s a reality that often gets overlooked:

In the pursuit of more money, you're often giving up something far more valuable —

Your free time and your health.

Health will always be more valuable than money.

And to get the most positive life experiences at any age, you must balance your life, and this requires you to exchange an abundant resource in order to get more of a scarce one.

Remember the famous Confucius quote of, “A healthy man wants a thousand things, a sick man only wants one".”

The Tradeoff You Might Not Be Thinking About

When you work additional years just to build more savings — probably more than you actually need — yes, you are gaining more money.

But at the same time, you’re losing more free time and your health is gradually declining.

More money doesn’t equal more experience points.

Every extra day you spend working is a day you give up the ability to use your time freely — and it’s a day closer to the reality that your health won’t be what it once was.

Example: If you delay retirement by five years to save more, your health doesn’t stand still during that time.

It declines by five years too.

That’s five fewer years when you could have been healthier, more energetic, and able to experience life more fully.

And here’s the real kicker: Those five years of extra savings often don't even begin to make up for the value of the experiences you lost.

This isn’t about abandoning careful planning or rushing into retirement overnight. It’s simply a reminder that as you plan, time and health deserve just as much attention as dollars and cents.

Start Thinking About Wealth Differently

Instead of thinking about your net worth as a dollar amount, I want you to think about it as a date.

The "peak utility" of your money — when it’s the most valuable to you — isn’t when you have the most dollars stacked up. Rather, it’s when your health, time, and money all intersect in a way that lets you enjoy life the most.

Let’s break it down:

A dollar in the hands of a 30-year-old — who is active, adventurous, and healthy — can use that dollar to fulfill meaningful experiences and memories.

That same dollar in the hands of someone in their 80s might not buy the same level of enjoyment, simply because of physical limitations.

IMPORTANT: This isn’t to say you can't enjoy your money well into your 80s and 90s.

You absolutely can — and you should.

It’s just that how you experience it will naturally evolve over time. And may look different than how you once enjoyed it in your thirties and fourties.

The point is, as you approach retirement with time and health still in your favor, it's worth considering — what if you began viewing these gifts through a different lens?"

Could you begin enjoying some of those meaningful experiences now — instead of putting them off for “someday”?

In short: Money has diminishing utility as we age.

You either get less enjoyment out of the same dollar, or you need to spend more dollars to achieve the same level of joy.

Bill Perkins: Die with Zero

The Takeaway

Saving and building wealth are critical — but at some point, the goal should shift.

Not toward more money, but toward more life and more experiences.

Your best wealth is measured in experiences, health, and time — not just dollars.

Knowing that, go and spend it wisely.

MARKETS TAKE THE STAIRS ON THE WAY UP AND THE ELEVATOR ON THE WAY DOWN

What happened to all the optimism from a few months ago?!

It’s gone.

Poof! It’s like it just evaporated overnight.

With the market down close to 3% in back to back weeks, something interesting happened:

Investor sentiment seemingly has fallen off a cliff.

CNN: Fear and Greed Index

Well, That Escalated Quickly

In an environment that is rapidly turning pessimistic, volatility is spiking, bond yields are falling, and the stock market is dropping from its recent highs, now roughly back to election day prices.

Investors aren’t just worried about the stock market.

There seems to be broadening concern about the future of our government, that our economy might implode, that Social Security and Medicare are in doubt, that global trade will come to a screeching halt, that geopolitical conflict is a real possibility, and so on.

It’s almost as if many investors feel that the world is at an inflection point.

So much so that I'm hearing people repeat the four most dangerous words in investing:

"This time is different."

While I could cite many examples of times when the world was, by most accounts, much scarier than today...

I know that recounting those events would be anything but helpful in this moment.

Those events are now distant memories, and we recall them as far less troubling because we know everything turned out fine.

But they were tenuous times, to say the least.

Despite history, many pundits are describing today’s surprises and uncertainties as “unprecedented.”

But are they?

As writer Kelly Hayes once said:

“Everything feels unprecedented when you haven’t engaged with history.”

Admittedly, it’s difficult to maintain patience and discipline in a world that feels like it’s falling apart.

I get it. I really do.

While I’m confident that history is as relevant as ever, I’ll admit that it may not provide much comfort as the storm clouds grow larger overhead.

But here’s a hard truth about today’s world:

Enduring uncertainty will not get any easier.

Our respective political preferences are irrelevant.

Thanks to our 24/7 access to real-time “news” that inevitably suits our pre-existing biases, we’re exposed almost exclusively to events that raise our blood pressure.

We’re all fed headlines that promote maximum anxiety and rage because that’s what keeps us coming back for more.

It’s as unfortunate as it is true.

So what can we do?

With all that said, I want to offer an idea that might encourage confidence and comfort when you feel your blood pressure rising.

Here it is: Remember that….

It is YOU who has put in the work.

It is YOU who has saved your hard earned dollars.

And it is also YOU who has planned meticulously for incredibly wide-ranging scenarios to make you and your financial plan as resilient as possible.

Does financial planning guarantee success?

Of course not.

But good planning does encourage confidence that you are prepared for the unexpected, regardless of how it presents itself.

We’ve known all along that uncertainty would return.

It always does.

But my reminder to you is that times like right now are not a time to abandon your plan.

In fact, this is when the planning you’ve done is most valuable.

Times like this are exactly why you have spent countless hours thinking, planning, and strategizing.

It’s all been in preparation for the incalculable world we live in.

I’m not asking you to believe that we know when or how things will calm down.

I am simply encouraging you to have faith that you've done the necessary work and that you are as prepared as reasonably possible for whatever comes your way next.

This too shall pass.

Eventually.

Thank you, as always, for reading!